MUTLIPLE OFFERS AGAIN?!?

The lack of available homes to purchase has resulted in buyers competing against each other to buy, despite low demand.

LOW SUPPLY and MULTIPLE BIDs

Market times have dropped like a rock since the start of the year, squeezed by not enough sellers.

In-N-Out has arguably the best cheeseburger. What started in Los Angeles has spread to nearly 400 locations in five states. They are also known for their long drive-thru lines. To avoid the long wait, many hungry, wise hamburger connoisseurs head over at a more favorable time, like 3 p.m. Unfortunately, to their surprise, they are greeted by an unexpected mile-long line.

Many buyers have a similar experience as they dive into today’s housing market. After hearing about falling home prices due to sky-high mortgage rates, they expect housing to be slow so they can take their time and not compete in purchasing a home. Instead, they are experiencing long lines of buyers at open houses and multiple offers on homes priced right and in reasonably good condition. Home buyers are frustrated once again.

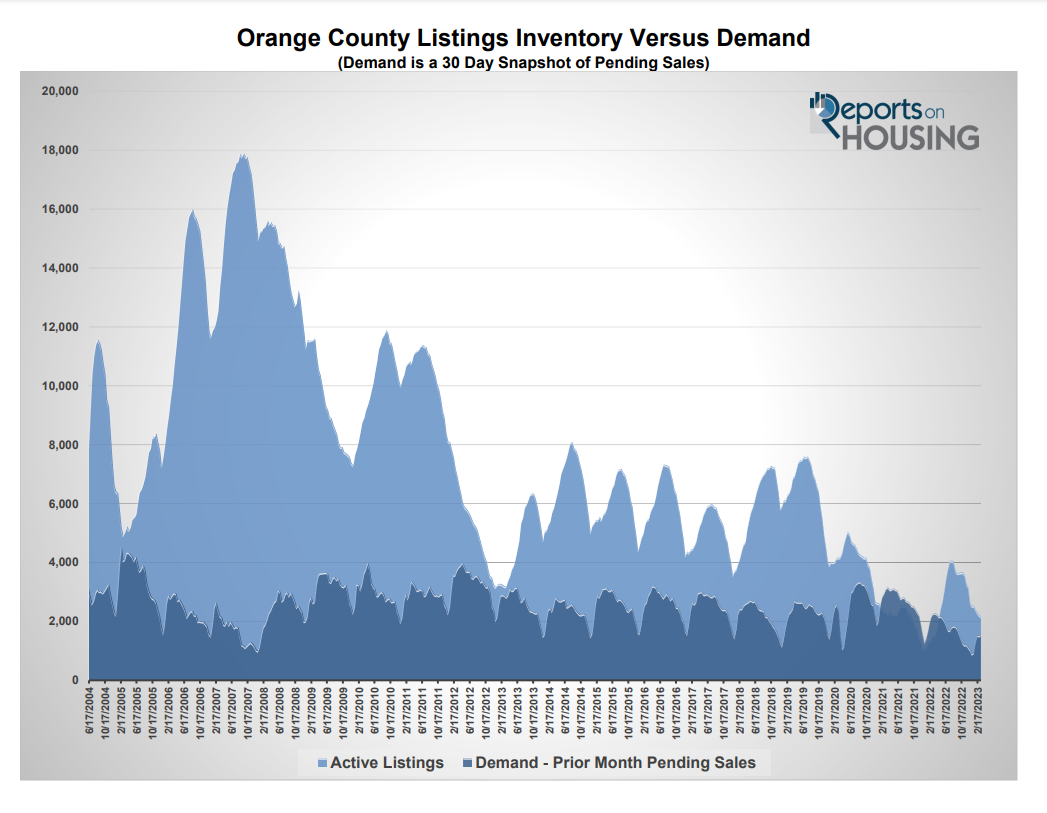

Ever since mortgage rates climbed above 6% in June, there has been a tug-of-war taking place between buyers and sellers: low demand, which favors buyers, pit against a low supply, which favors sellers. Last year, inventory kept growing until it peaked in August, while demand continued to drop after peaking in March with rising rates. Market times rose from 19 days in March to 45 days in June to 72 days in July. By November, the market time reached 89 days, drastically different than the first five months of the year. As market times grew, buyers had the upper hand. The pool of buyers evaporated due to affordability constraints. The remaining buyers were not tripping over each other to purchase, they were unwilling to overpay for a home, and the few houses on the market took longer to sell. The sense of urgency that characterized the market from June 2020 through May 2022 had vanished. According to the Freddie Mac House Price Index, as of January, the Los Angeles/Orange County region has dropped 8% since May and was down 2% year-over-year.

In January 2022, there were 1,100 homes available, and demand, the last 30 days of pending sales activity, was at 1,295. Demand was higher than the supply of available homes, and the market time was less than 30 days for all of Orange County. It was insanely hot, with way too much buyer competition, multiple offers, and sales prices way above the asking prices. With rising rates, the supply increased rapidly while demand was falling. In May, demand was less than the supply, which is normal. The difference between supply and demand grew. At the end of July 2022, demand dropped to 1,693 pending sales, and the inventory had reached 4,041. Supply was 2,348 higher than demand, the largest gap in 2022.

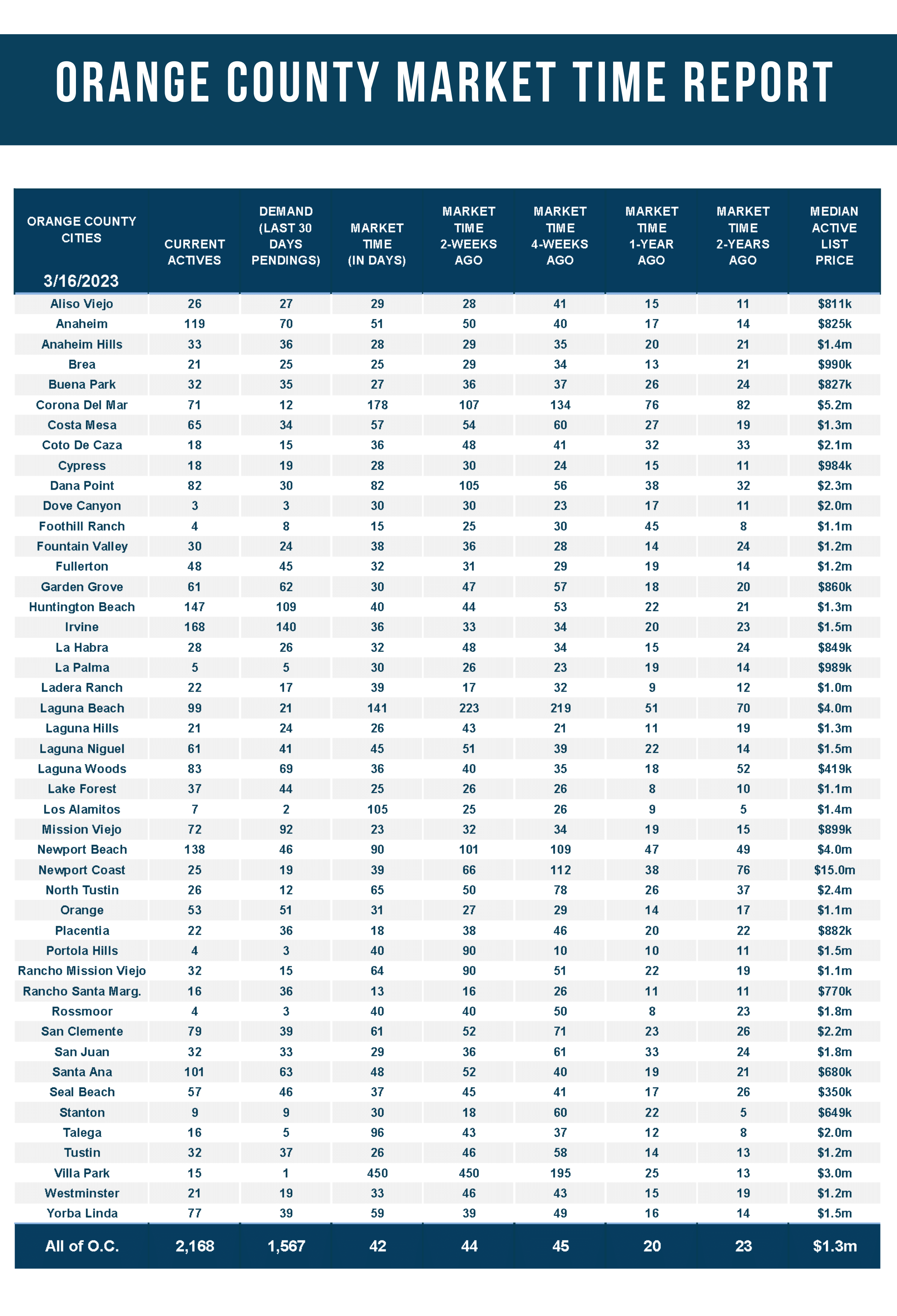

The housing market has evolved yet again in 2023. The supply of available homes has been dropping while buyer demand has risen. The inventory declined from 2,530 homes in January to 2,168 today, a drop of 14%. On the other hand, demand has grown from 900 pending sales in January to 1,567 today. The difference between supply and demand has diminished from 1,630 in January to 601 today, its smallest difference since May last year. The market time dropped from 84 days in January to 42 days today, its lowest level since May 2022. Anything below 50 days indicates that not enough homes are available to purchase and sell.

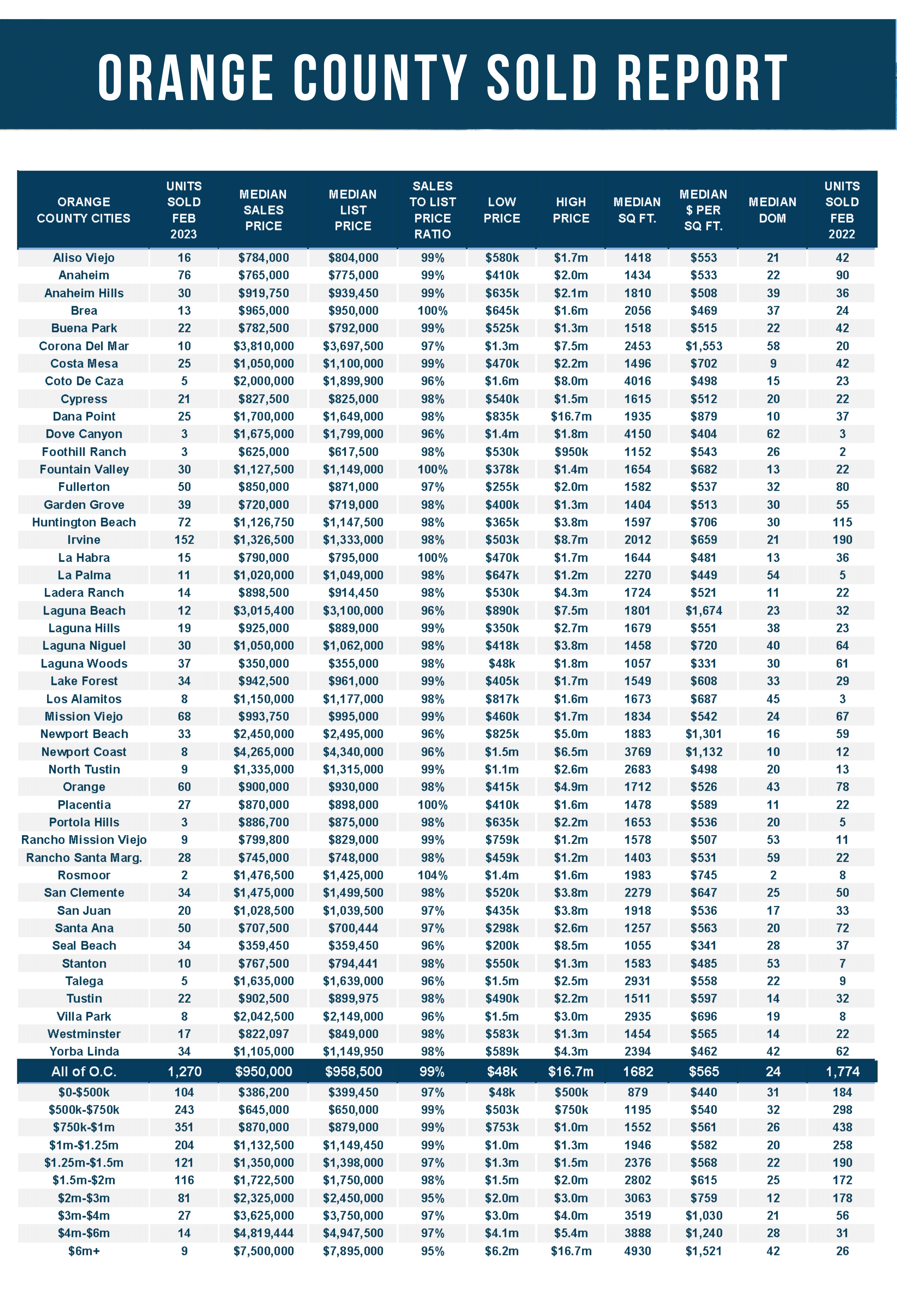

Two-thirds of Orange County cities have an Expected Market Time of less than 50 days. Rancho Santa Margarita has the lowest market time at 13 days, with only 16 available homes and demand at 36 pending sales. All homes below $1.5 million have a market time below 40 days. The fastest price range is homes between $500,000 and $1 million, with a market time of only 28 days.

At 42 days, Orange County buyers are once again experiencing long lines of buyers at open houses, multiple offer situations, and sales prices above the asking price. This is not due to heightened demand. High mortgage rates are inhibiting demand. Instead, it is a result of not enough new sellers and a muted inventory. So far this year, in January through February, there have been 2,793 missing FOR-SALE signs compared to the 3-year average before COVID (2017 to 2019), down 45%. Today’s buyers cannot buy want is not for sale, so buyers in today’s marketplace are waiting for homes to be placed on the market. As soon as a home becomes available, if it is in decent shape and priced right, it will be greeted with plenty of buyer traffic and interest.

A WARNING FOR SELLERS: This is NOT the insane market from June 2020 to May 2022, where values were screaming higher. Sellers may have the advantage, but overpricing a home is futile. Homes with deferred maintenance or a poor location will be extremely challenging to sell without adjusting the price. Price a home according to its Fair Market Value based on condition, location, upgrades, amenities, and age. Multiple offers may be back, but sellers should not get overzealous.

Source: Steven Thomas / Reports on Housing