Housing Insanity Returns

With the number of available homes to purchase at extremely low levels, buyers are competing against each other despite high mortgage rates.

A Seller’s Market

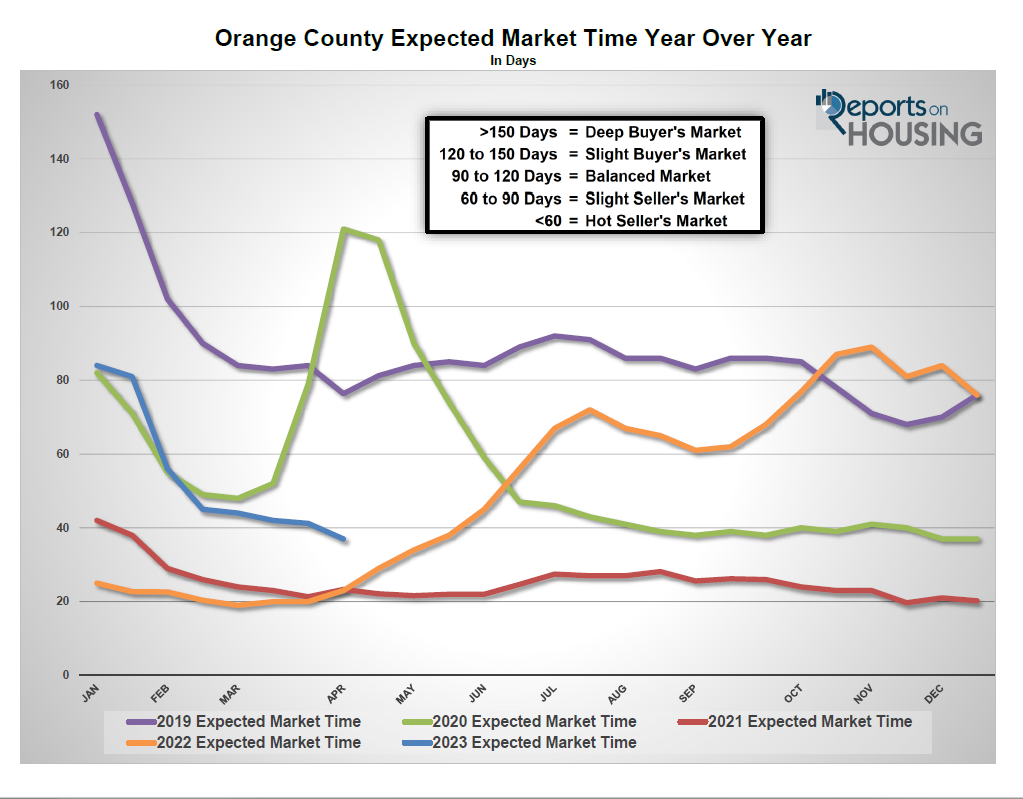

When the Expected Market Time drops below 40 days, the housing market leans heavily in favor of sellers.

A three-bedroom, two-and-a-half bathroom, 2,100 square foot home on a 3,700 square foot lot, built in 2003, was placed on the market on the second Tuesday of March at $1,099,000. There was a steady stream of buyers during a three-hour window on Saturday and a two-hour window on Sunday. By Monday evening, more than 20 offers were submitted to the listing agent. The seller countered all offers and asked them to return with their highest and best price. The home closed during the second week of April at $1,145,000, an astonishing 4% above its list price.

Not every home sells above the asking price, especially in today’s high mortgage rate environment. The sales-to-list price ratio for detached homes priced below $2 million so far in April is 99.9%. For luxury homes, anything priced above $2 million (the top 10% of closings), it drops to 94%. The median time on the market is nine days, a little over a week. It would probably be even faster, but there are too many offers for many sellers to sift through.

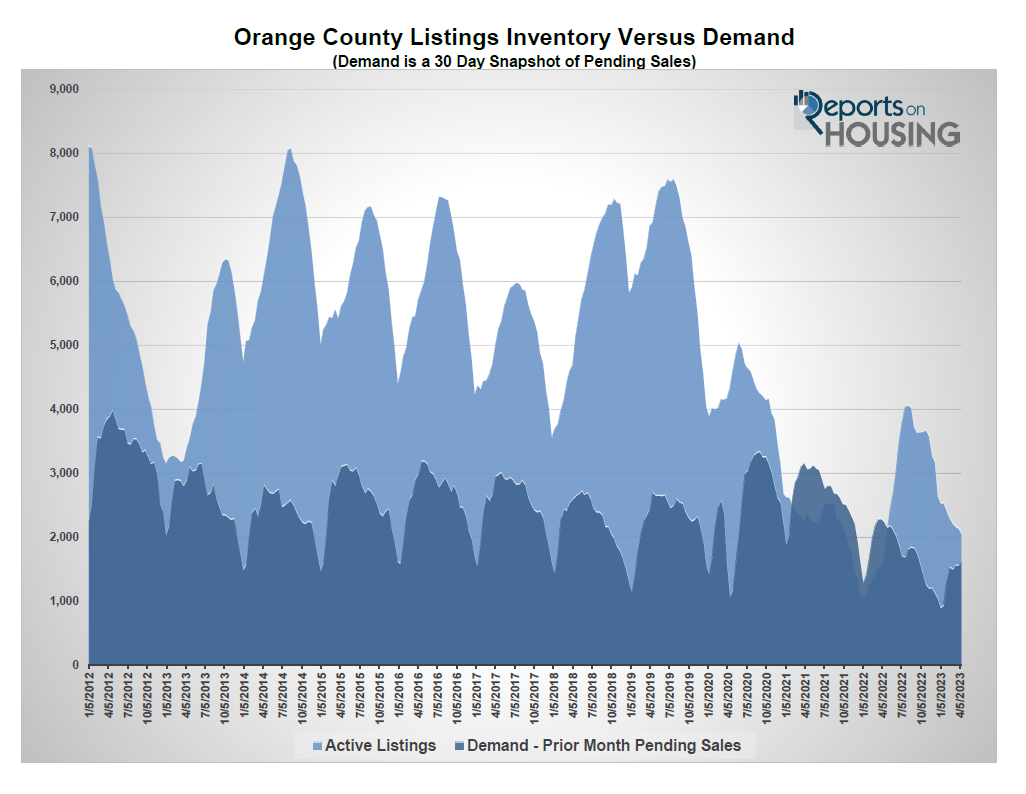

The Expected Market Time, the time between coming on the market and opening escrow, is a function of supply, the number of available homes, and demand, a snapshot of recent pending sales activity. Typically, the inventory slowly grows from January through March and then picks up steam during the spring. This year, the inventory dropped from 2,530 in January to 2,053 today, plunging by 19%. The 3-year average mid-April inventory before COVID (2017 to 2019) was 5,780, an unbelievable 182% higher than today. Demand has increased from 900 pending sales to 1,663 today, an 85% rise. The 3-year pre-COVID average was 2,777, 67% higher than today, its lowest level for mid-April since 2020, during the initial pandemic lockdowns. Demand readings are down because of higher rates and fewer homes available to place into escrow.

Despite muted demand readings, the Expected Market Time has dropped like a rock. With the inventory dropping while demand expands, market times continue to fall. It was 84 days in January and has sunk to 37 days today, plunging below 40 days for the first time since May 2022. The housing market feels hot when the market time dips below 60 days. Buyers can no longer take their time. Housing lines up in the seller’s favor, and home values are sticky and no longer falling even with mortgage rates in the mid 6’s. When a home is accurately priced, and in good condition, it acquires instant attention and sells fast. When market times drop below 40 days, the housing market feels insane. This is when sellers get to call all of the shots, home values are rising again, multiple offers are the norm, sales prices often exceed their asking prices, and homes last only days on the market.

Buyers entering the market today are blown away at just how fast homes that are in good condition and priced according to their Fair Market Values are flying off the market with dozens of offers to purchase. Open houses are bursting at the seams. In some cases, inspection and appraisal contingencies are once again being waived like they were when mortgage rates were below 3%.

Today’s 37-day Expected Market Time means that housing has once again dipped below the level where the pace is unreal. It was at 23 days in both 2021 and 2022 when home values were skyrocketing higher. In 2013, the Expected Market Time was at 33 days, the only year before COVID that reached the white-hot level for housing. The six-year average from 2014 to 2019 for this time of year was 61 days, much different than the current insane pace. With patience, buyers could isolate a home within a reasonable amount of time and were not competing against so many buyers writing offers on nearly every home.

There is nothing available for buyers to purchase right now. Anything that does hit the market is inundated with showings and plenty of offers as long as the home is in reasonable shape and the seller is not stretching the asking price. There is nothing spectacular about the number of buyers looking to purchase today. Today’s insane pace is not a function of juiced demand. The issue is that there are only 2,053 homes available today in the middle of April when there are typically around 5,800 (the 3-year average between 2017 to 2019). The lack of FOR-SALE signs in every community is why today’s housing market is insane.

Housing insanity has returned to Orange County, and it will not change anytime soon. However we REALLY know this market and can help you navigate either buying or selling for a successful outcome. Let us know if you have questions or would like meet to develop a strategy and plan.